POS Invoice

Introduction

An invoice is a document that records transaction details between a buyer and a seller and usually carries a list of items sent or services provided by the seller. If the items or services were purchased in cash, the invoice will carry with it a statement of the amount due. If the items or services were purchased on credit, the invoice will not only carry with it a statement of the amount due and the due date, but will also specify the payment terms and include information on the available modes of payment.

An invoice is considered valid only when it carries a date and time stamp, a unique identifier (invoice number), and must clearly say on its face that it is an "Invoice". The date and time will dictate the credit duration and due date. This is crucial especially for entities that offer credit. The invoice number can be used for both internal and external reference.

POS invoice has been introduced in iVendNext with the sole purpose of facilitating faster data sync between iVendNext POS and iVendNext. It is just a regular invoice designed to record quick sale and immediate payment. By quick sale we mean you just need to add items, select a customer, and accept immediate payment. This process is much faster as compared to that on a regular invoice. It neither runs as many checks as in the Sales invoice nor does not have any effect on accounts. POS Invoices are designed to be printed on “till-tape” instead on a standard 8½ x 11 sheet of paper.

Purpose

The concept of POS invoice has been introduced in iVendNext with the sole purpose of facilitating faster data sync between iVendNext POS and iVendNext. The section explains it further.

Make an intermediate invoice while transacting with the iVendNext POS.

POS Invoices created in a day will be consolidated / merged into a single Sales Invoice at the time of closing.

POS Invoices are interim invoices that do not affect accounting or stock ledger.

At the time of consolidation, the combined accounting and stock ledger entries will be made. The resulting consolidated Sales Invoice will then contain all the items purchased by a customer in a day or between the opening and the closing period. See: POS Invoice Consolidation

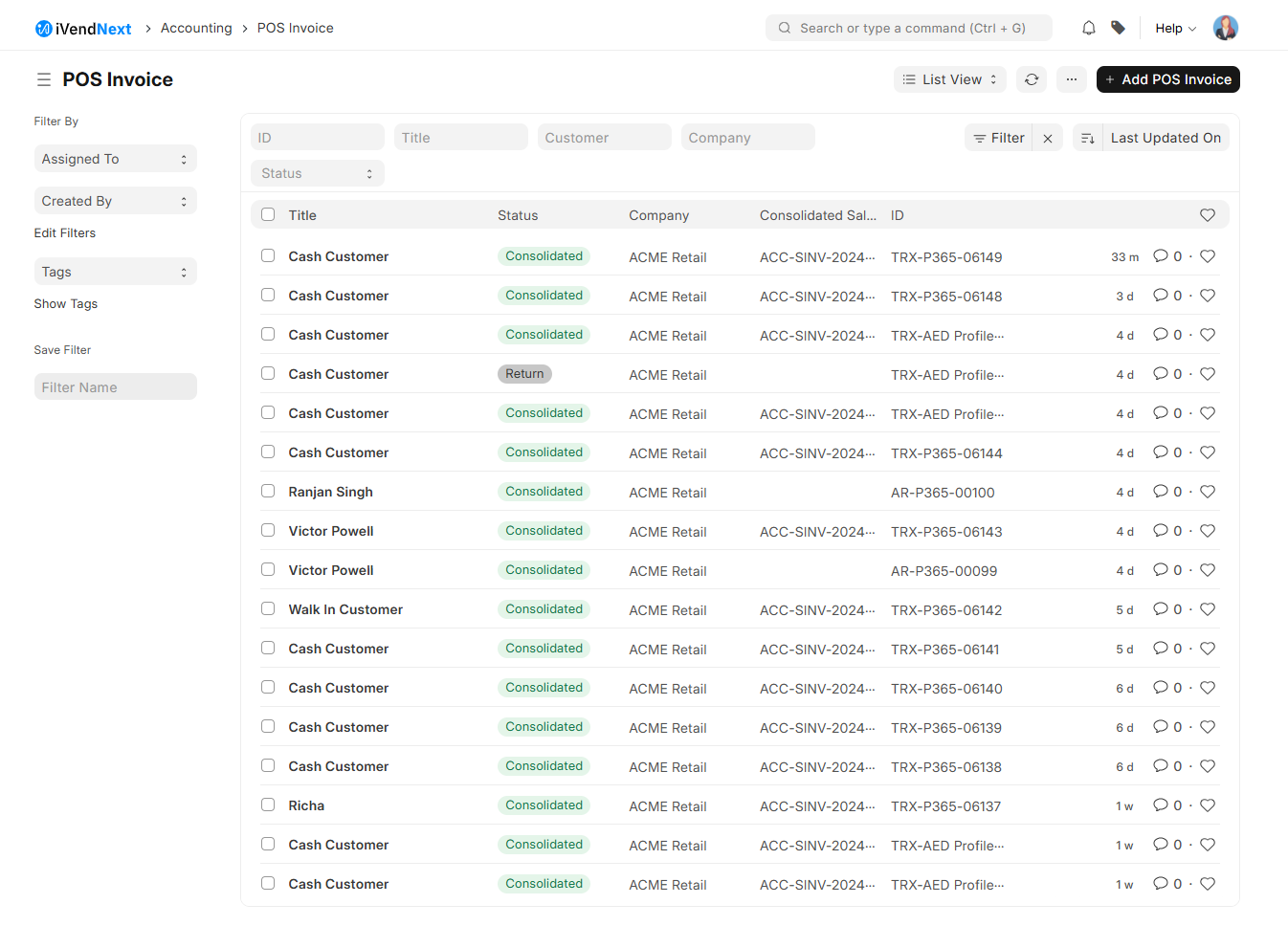

To access the POS Invoice list, go to: Home > Selling > Reports and Masters > POS Invoice.

Prerequisites

Before creating and using a POS Invoice, it is advised to create the following first:

Creating a Sales Order and Delivery Note are optional.

Steps to create a POS Invoice

POS Invoice is automatically created when a POS transaction is performed. It is not recommended to create a POS invoice manually. However, if still the need arises you can follow the below steps to create a POS Invoice manually:

Navigate to Home > Selling. Then under the Reports and Master Section click on the POS Invoice shortcut.

This should take you to the POS Invoice List View screen.

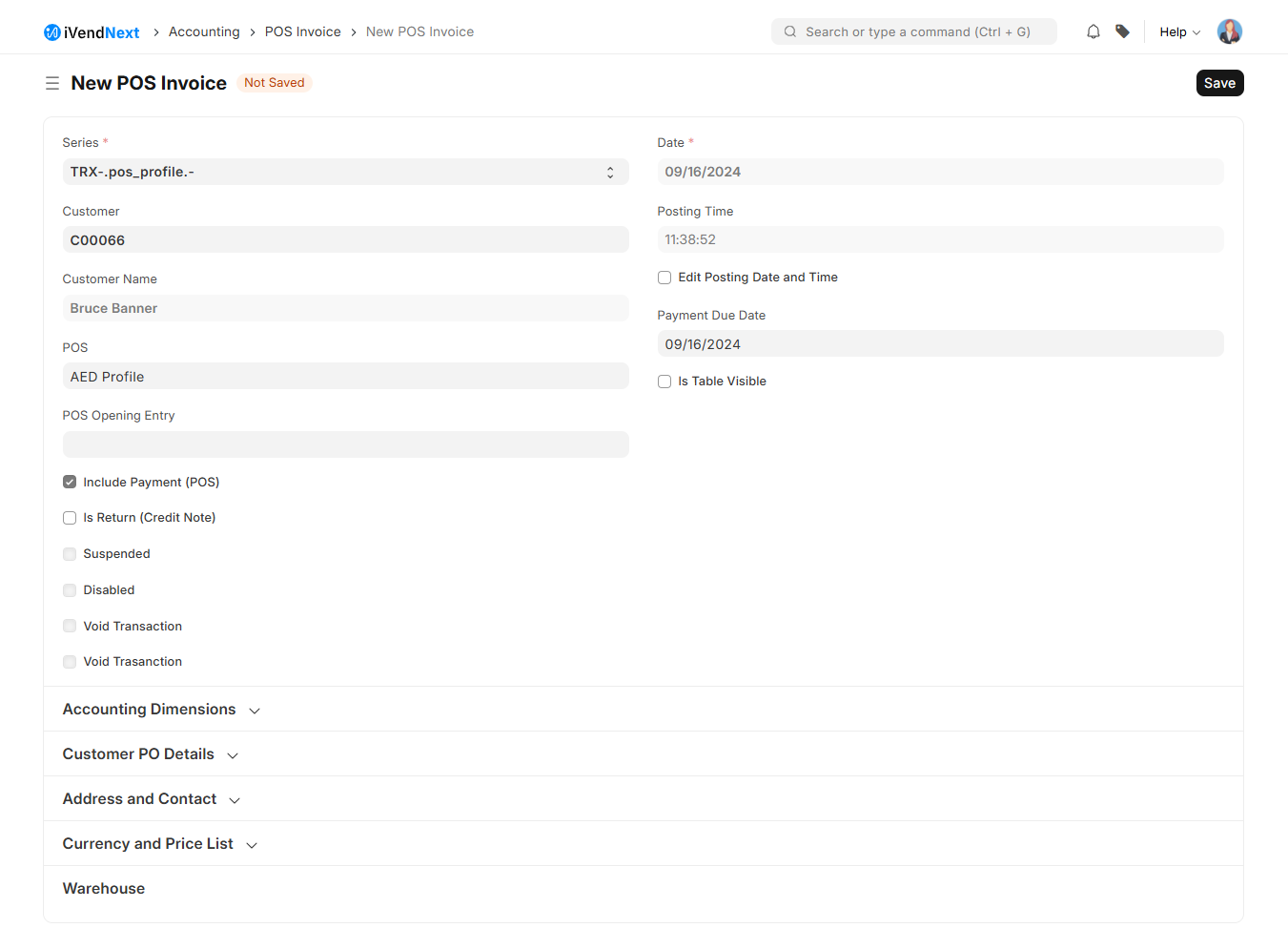

Click on the Add POS Invoice button. This will take you to the New POS Invoice screen. Fill in the required information including the mandatory fields on the New POS Invoice screen. All the mandatory fields are marked with red asterisks.

Once you have filled in the required information including the mandatory fields click the Save button to save the New POS Invoice settings and exit the screen. This will create a New POS Invoice.

Status Types

These are the status types that are auto-assigned to a POS Invoice.

Draft:

A draft is saved but yet to be submitted.

Consolidated:

The invoice has been consolidated.

New POS Invoice Screen Explained

The various settings on the New POS Invoice are explained below:

Series

Select the POS Invoice Series. This field is mandatory.

Customer

Specify the Customer name. Select a Customer from the drop down list or choose to create a new customer record by clicking on the Create a new Customer option.

POS

Specify the POS profile. Select a POS Profile from the drop down list or choose to create a new POS Profile by clicking on the Create a new POS Profile option. All the settings pertaining to your POS terminal collectively form a POS profile. These settings are specific to your POS terminal and can be found under the Settings and Configuration module on iVend Next.

Date

Specify the Date. This field is mandatory. By default the application picks up the current system date.

Posting Time

Specify the Posting Time. By default the application picks up the current system date and time. This field can be edited using the “Edit Posting Date and Time” checkbox.

Edit Posting Date and Time

Check this box if you want to manually edit the Date and Posting Time fields.

Payment Due Date

Specify the Payment Due Date. Click on the Payment Due Date field to open the calendar pop up screen and then click on a date to select it.

Is Table Visible

Check this box if you

Include Payment (POS)

Check this box if this invoice is for retail sales / Point of Sale. See: Sales Invoice.

Is Return (Credit Note)

Check this box if the customer has returned the Items. A Credit Note is a document sent by a seller to the Customer, notifying that a credit has been made to their account against the goods returned by the buyer. A Credit Note is issued for the value of goods returned by the Customer, it may be less than or equal to the total amount of the order.

To know more details, visit the Credit Note page.

Suspended

Check this box if the transaction is suspended.

Disabled

Check this box if you

Void Transaction

Check this box if the transaction is void.

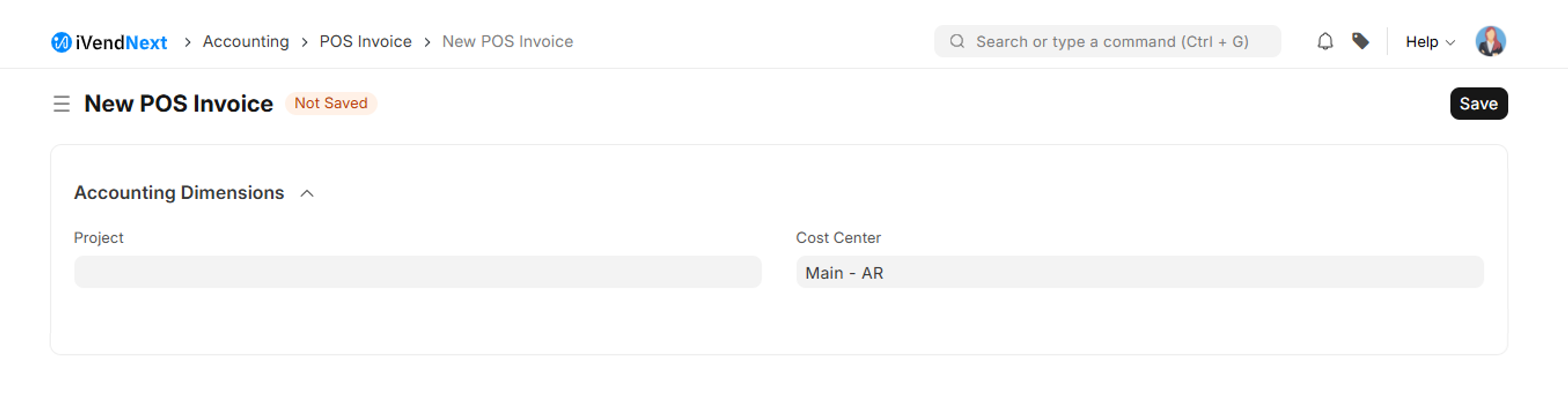

Accounting Dimensions

The settings in this section allow you to tag transactions based on a specific Territory, Branch, Customer, etc. Cost Center and Project are treated as dimensions by default in iVendNext. Cost Center and Project are treated as dimensions by default in iVendNext. On setting a field in Accounting Dimension, that field will be added in transactions reports where applicable. See: Accounting Dimensions

Cost Center

Cost centers are crucial for budgeting and financial management as they represent distinct areas or departments within a company where costs are incurred and tracked. Accounting Dimensions help to tag each transaction with different Dimensions without the need for creating new Cost Centers. Dimensional accounting means tagging each transaction with appropriate dimensions like Branch, Business Unit, etc. This allows you to maintain each segment separately, thereby limiting the overall maintenance on GL accounts and your Chart of Accounts remains pure. See: Accounting Dimensions

Project

Accounting Dimensions help to tag each transaction with different Dimensions without the need for creating new Cost Centers. Dimensional accounting means tagging each transaction with appropriate dimensions like Branch, Business Unit, etc. This allows you to maintain each segment separately, thereby limiting the overall maintenance on GL accounts and your Chart of Accounts remains pure. Cost Center and Project are treated as dimensions by default in iVendNext. On setting a field in Accounting Dimension, that field will be added in transactions reports where applicable. See: Accounting Dimensions

Customer PO Details

The settings in this section allow you to capture Customer PO Details. You can capture the Customer’s Purchase Order and Customer’s Purchase Order Details.

Customer's Purchase Order

Track customer's PO No. received, primarily to prevent the creation of duplicate Sales Order or Invoice for the same PO received from the Customer. You can do more configuration related to customer's PO No. validation in Selling Settings

Customer's Purchase Order Date:

The date when the Purchase Order was raised.

Customer Address Name

Select the Customer Address from the drop down list or choose to create a new Customer Address by clicking on the create a new Address option.

Customer Address

The value in this field is automatically fetched based on the option selected in the Customer Address Name field.

Contact Person

Select a Contact Person from the drop down list or choose to create a new Contact by clicking on the Create a new Contact option. If the Customer is a company, the person to be contacted is fetched in this field if set in the Customer form.

Shipping Address Name

Select a Shipping Address from the drop down list or choose to create a new Shipping Address by clicking on the Create a new Address option.

Shipping Address

Address where the items will be shipped to. The value in this field is automatically fetched based on the option selected in the Shipping Address Name field. For India, the following details can be recorded for GST purposes. You can capture these details in the Address and Customer master, which would be fetched in the Sales Invoice.

Billing Address GSTIN

Customer GSTIN

Place of Supply

Company GSTIN

Company Address Name

Select a Company Address from the drop down list or choose to create a new Company Address by clicking on the Create a new Address option.

Territory

Select a Territory from the drop down list or choose to create a new Territory by clicking on the Create a new Territory option. A Territory is the region where the Customer belongs to, fetched from the Customer form. The default value is All Territories.

Currency

Select a Currency from the drop down list or choose to create a new Currency by clicking on the Create a new Currency option. Maintain a separate receivable account in the Customer's currency. The Receivable for this invoice should be posted in that currency itself. Read Multi Currency Accounting to learn more.

Price List

Select a Price List from the drop down list or choose to create a new Price List by clicking on the Create a new Price List option. The prices will be fetched automatically if Item Price is added, else add a price in the table. See: Price List

Ignore Pricing Rule

Check this box if you want to ignore the Pricing Rule. This implies that the Price List that you have specified in the previous field will no longer hold good. See: Pricing Rules

Source Warehouse

Select a Warehouse from the drop down list or choose to create a new Warehouse by clicking on the Create a new Warehouse option.

Update Stock

Check this box if you want to reconcile and update stock information on successful completion of the POS transaction.

Customer's Purchase Order

Track customer's PO No. received, primarily to prevent the creation of duplicate Sales Order or Invoice for the same PO received from the Customer. You can do more configuration related to customer's PO No. validation in Selling Settings

Customer's Purchase Order Date

The date on which the Customer placed the Purchase Order.

Update Stock

Ticking this checkbox will update the Stock Ledger on submitting the Sales Invoice. If you've created a Delivery Note, the Stock Ledger will be changed. If you're skipping the creation of Delivery Note, tick this checkbox.

Scan Barcode

You can add Items in the Items table by scanning their barcodes if you have a barcode scanner. Read documentation for tracking items using barcodes to know more.

Grant Commission

Grant a commission to Sales Person and Sales Partner on the net amount of this line item. If disabled, this line item will be ignored in the calculation of commission.The Item Code, name, description, Image, and Manufacturer will be fetched from the Item master.

Discount and Margin

You can apply a discount on individual Items percentage-wise or on the total amount of the Item. Read Applying Discount for more details.

Rate:

The Rate is fetched if set in the Price List and the total Amount is calculated.

Drop Ship

Drop Shipping is when you make the sales transaction, but the Item is delivered by the Supplier. To know more, visit the Drop Shipping page.

Accounting Details

The Income and Expense accounts can be changed here if you wish to. If this Item is an Asset, it can be linked here. This is useful when you're selling an Asset.

Deferred Revenue

If the income for this Item will be billed over the coming months in parts, then tick on 'Enable Deferred Revenue'. To know more, visit the Deferred Revenue page.

Item Weight

The Item Weight details per unit and Weight UOM are fetched if set in the Item master.

Stock Details

The following details will be fetched from the Item master:

Warehouse:

The Warehouse from where the stock will be sent.

Available Qty at Warehouse

The quantity available in the selected Warehouse.

Batch No and Serial No

If your Item is serialized or batched, you will have to enter Serial Number and Batch in the Items table. You are allowed to enter multiple Serial Numbers in one row (each on a separate line) and you must enter the same number of Serial Numbers as the quantity.

Item Tax Template

You can set an Item Tax Template to apply a specific Tax amount to this particular Item. To know more, visit this page.

References

If this Sales Invoice was created from a Sales Order/Delivery Note, it'll be referred here. Also, the Delivered Quantity will be shown.

Page Break

Page Break will create a page break just before this Item when printing.

Timesheet

If you want to bill Employees working on Projects on an hourly basis (contract based), they can fill out Timesheets which consist of their billing rate. When you make a new Sales Invoice, select the Project for which the billing is to be made, and the corresponding Timesheet entries for that Project will be fetched. If your Company's Employees are working at a location and it needs to be billed, you can create an Invoice based on the Timesheet.

Taxes and Charges

The Taxes and Charges will be fetched from the Sales Order or Delivery Note. Visit the Sales Taxes and Charges Template page to know more about taxes.

The total taxes and charges will be displayed below the table. To add taxes automatically via a Tax Category, visit this page.

Make sure to mark all your taxes in the Taxes and Charges table correctly for an accurate valuation.

Shipping Rule

A Shipping Rule helps set the cost of shipping an Item. The cost will usually increase with the distance of shipping. To know more, visit the Shipping Rule page.

Loyalty Points Redemption

If the Customer is enrolled in a Loyalty Program, they can choose to redeem it. To know more, visit the Loyalty Program page.

Additional Discount

Any additional discounts to the whole Invoice can be set in this section. This discount could be based on the Grand Total i.e., post tax/charges or Net total i.e., pre tax/charges.

The additional discount can be applied as a percentage or an amount. Visit the Applying Discount page for more details.

Advance Payment

For high-value Items, the seller can request an advance payment before processing the order. The Get Advances Received button opens a popup from where you can fetch the orders where the advance payment was made. To know more, visit the Advance Payment Entry page.

Payment Terms

The payment for an invoice may be made in parts depending on your understanding with the Supplier. This is fetched if set in the Sales Order. To know more, visit the Payment Terms page.

Write Off

Write off happens when the Customer pays an amount less than the invoice amount. This may be a small difference like 0.50. Over several orders, this might add up to a big number. For accounting accuracy, this difference amount is 'written off'. To know more, visit the Payment Terms page.

Terms and Conditions

There may be certain terms and conditions on the Item you're selling, these can be applied here. Read Terms and Condition documentation to know how to add them.

Transporter Information

If you outsource transporting Items to their delivery location, the transporter details can be added. This is not the same as drop shipping. The details are usually fetched from the Delivery Note.

Transporter

The Supplier who will transport the Item to your Customer. The transporter feature should be enabled in the Supplier master to select the Supplier here. The details are usually fetched from the Delivery Note.

Driver

You can add a Driver here who will drive the mode of transport. The details are usually fetched from the Delivery Note.

The following details can be recorded:

Distance in km

Mode of Transport whether road, air, rail, or ship.

For India, GST:

GST Transporter ID

Transport Receipt No

Vehicle No The GST Vehicle Type can be changed

The Transport Receipt Date and Driver Name

Letterhead

You can print your Sales Invoice on your Company's letterhead. Know more here.

'Group same items' will group the same items added multiple times in the Items table. This can be seen when your print.

Print Headings

Sales Invoice headings can also be changed when printing the document. You can do this by selecting a Print Heading. To create new Print Headings go to: Home > Settings > Printing > Print Heading. Know more here.

There are additional checkboxes for printing the Sales Invoice without the amount, this might be useful when the Item is of high value. You can also group the same Items in one row when printing.

GST Details (for India)

The following details can be set for GST:

GST Category

Invoice Copy

Reverse Charge

E-commerce GSTIN

Print Heading

More Information

The following Sales details can be recorded:

Campaign

If this invoice is a part of an ongoing sales Campaign, it can be linked. To know more, visit the Campaign page.

Source

A Lead Source can be tagged here to know the source of sales. To know more, visit the Lead Source page.

Accounting Details

Specify the accounting details.

Debit To

The account against which receivable will be booked for this Customer.

Is Opening Entry

If this is an opening entry to affect your accounts select 'Yes'. i.e. if you're migrating from another ERP to iVendNext mid year, you might want to use an Opening Entry to update account balances in iVendNext.

Remarks

Any additional remarks about the Sales Invoice can be added here.

Commission

If the sale took place via one of your Sales Partners, you can add their commission details here. This is usually fetched from the Sales Order/Delivery Note.

Sales Team

Sales Persons: iVendNext allows you to add multiple Sales Persons who may have worked on this deal. This is also fetched from the Sales Order/Delivery Note.

Automatically Fetching Item Batch Numbers

If you are selling an Item from a Batch, iVendNext will automatically fetch a batch number for you if "Update Stock" is checked. The batch number will be fetched on a First Expiring First Out (FEFO) basis. This is a variant of First In First Out (FIFO) that gives the highest priority to the soonest to expire Items. Note that if the first batch in the queue cannot satisfy the order on the invoice, the next batch in the queue that can satisfy the order will be selected. If no batch can satisfy the order, iVendNext will cancel its attempt to automatically fetch a suitable batch number.

POS Invoices

Consider a scenario where the retail transaction is carried out. For e.g: A retail shop. If you check the Is POS checkbox, then all your POS Profile data is fetched into the Sales Invoice and you can easily make payments. Also, if you check the Update Stock the stock will also update automatically, without the need for a Delivery Note.

POS Invoice Consolidation

In an effort to add speed to the Point of Sale, the sales from the POS session do not affect the stock and accounting ledgers until a Closing POS Voucher is submitted for that session. It functions like so:

Each transaction from the POS screen now creates an intermediate invoice (called a POS Invoice) which doesn’t update the stock and accounting ledgers to keep it as fast as possible. This is also called a “sub-ledger”. Separating the POS ledger from the General Ledger makes the system a lot more scalable.

The stock and accounting entries are now created at the end of day while closing a POS session by a single sales invoice which merges all the intermediate POS invoices created throughout the day.

This single consolidated sales invoice only creates 3-4 ledger entries. The older system would create n x 3 ledger entries where ‘n’ is the number of invoices created throughout the day.

Since drastically fewer ledger entries are made, the load on the general ledger is also eased, making it faster.